Life Insurance

ABOUT CLAIMS

TYPE OF CLAIMS

Death Claims

A claim filed by the beneficiary, post the death of the life insured. The beneficiary designated under the policy at the time of signing of the proposal form is entitled to get the policy benefits.

Maturity Claim

Maturity claim arises post completion of the term of the policy. Depending upon the type of policy, the insurance company pays the sum assured / final installment of the survival benefit along with any guaranteed addition or bonus (if any) to the policyholder, post submission of all the required documents.

HOW TO FILE A CLAIM?

It is advisable to intimate the claim to the Insurance Company at the earliest after the insured event happens.

In case a claim situation arises, you can do any the following;

- Contact the respective life insurance branch office.

- Contact your agent advisor

- Call the respective Customer Care Helpline

- Visit the Insurer’s website for claims process assistance

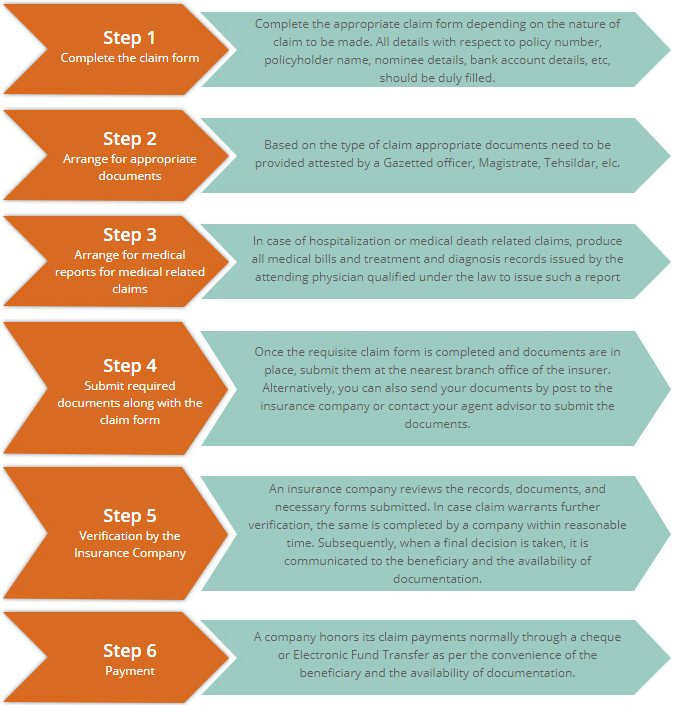

CLAIM SETTLEMENT PROCESS:

DOCUMENTS REQUIRED

- Death Certificate

- Original Policy Pack

- Claim Forms issued by the insurer

- Photo Identity Proof of the beneficiary

- Copy of Bank Passbook and/or a cancelled cheque

For Maturity Claims (On or after the date of maturity):

- Original Policy Pack

- Maturity Claim Form issued by the insurer

- Copy of Bank Passbook and/or a cancelled cheque